A Pipe Dream? Main Takeaways from the China-Russia Siberia 2 Pipeline ‘Deal’

22 September 2025

Earlier in September, the CEO of the Russian energy company Gazprom announced the signing of a ‘binding memorandum’ on the construction of the Power of Siberia 2 (PoS 2) gas pipeline. The ambition is to connect the Russian Yamal Peninsula to Northern China, as a boon for Chinese industry and households in North-Eastern Provinces. It would also serve as a vital outlet for Russian gas exports, currently in a slump. International pundits and media were quick to hype the importance of the deal and interpret it as a token of the strategic ‘no-limit’ partnership between China and Russia. There is important context and detail, however, amidst all of the Kremlin’s usual propaganda optics.

- The memorandum is still a paper tiger

There are little, if any, technicalities, specifics, or financials details on the actual deal. The projected pipeline infrastructure would be costly and would provide potential output only in the mid-2030s. There are heavy doubts about Gazprom’s ability to support such upfront costs, given the financial state of the company. Moscow itself has diminishing capacity to re-direct funds to large non-military projects. In the case of the PoS 1 project, Russia was left in the cold to cover the costs for the domestic section of the pipeline.

To date, the Chinese state is yet to confirm the deal. Beijing is in a formidable position to stall, extort and delay until it gets the best terms and price. This has been their tactic for a decade. Dwindling demand for LNG imports and an increase in domestic natural gas production also put a question mark over the long-term demand for the alleged 50 billion cubic metres (bcm) of gas deliveries. The Kremlin would need to take a high-risk, high-interest loan for an infrastructure project that could become a stranded asset. Financial markets are no dummies – Gazprom stock actually fell (!) after the announcement of the memorandum.

Gazprom stock price, August-September 2025

- China is patiently pursuing its fossil fuel and clean energy goals

The intentional ambiguity pursued by the People’s Republic of China about their commitment to PoS 2 reflects its substantial leverage over Putin. Russia, indeed, is looking more akin to a vassal state due to its dependence on the Chinese for both supply and demand. What is noteworthy from the latest memorandum is Beijing’s greenlight on expanding the capacities of the already functional PoS 1 from 38 bcm to 44 bcm annually, while also boosting the commitment on the Far-Eastern routes.

These expanded volumes would neatly add up on top of China’s intentional increase of domestic supply from the fields in Sichuan and other gas-rich heartland regions. Chinese planners managed to surpass the stringent goals set from the Chinese Communist Party (CCP) for expanding domestic production to 230 bcm annually. This is a great hedging of the bets against the US, as Beijing has frozen all imports of American LNG since the beginning of the year. As highlighted by a designated Martens Centre report on China’s energy outlook, the CCP is pursuing a long-term strategy for diversifying their energy import portfolio and balancing their exposure to third countries. Naval route blocks and curtailed energy shipments remain a strategic vulnerability for Beijing.

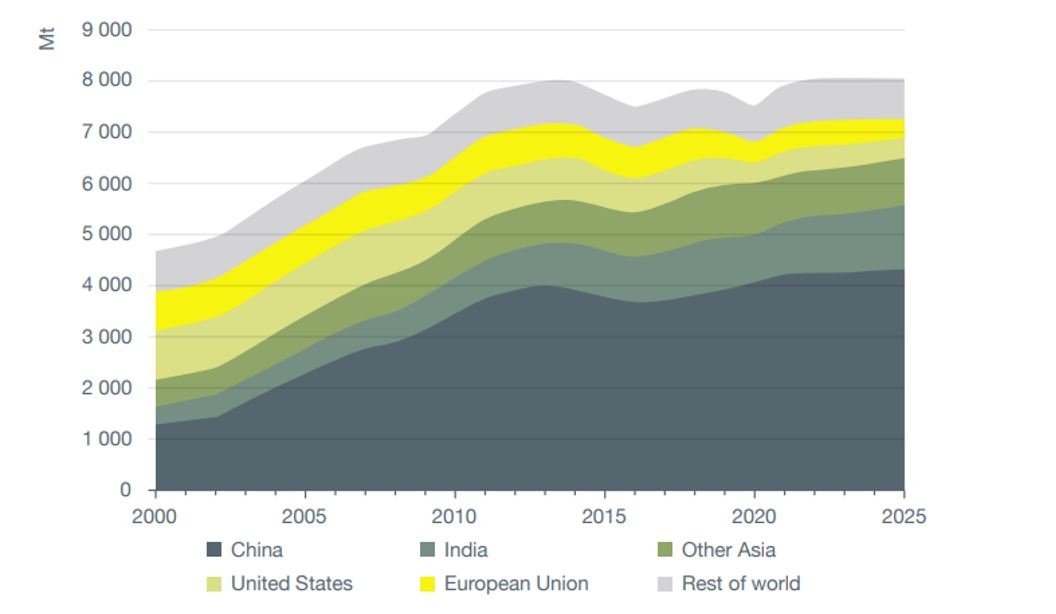

Make no mistake, even though China is leading the roll-out of renewables, 80 % of its energy needs are still (and will) be covered by coal, oil and gas. Deploying hundreds of GWs of renewable sources is a formidable task, but it only comes on top of a dirty, energy-intensive economic model that will persist deep into the 2030s. Beijing will continue its pragmatic energy policy of balancing LNG, pipeline gas deliveries, coal/gas domestic production, in parallel to nuclear and renewable deployment.

Global coal consumption, 2000-2025

Source: Wilfried Martens Centre for European Studies

- The Kremlin feels the pressure from all sides

It is no wonder that Russia is desperate to open more gas valves to China. Europe was once Gazprom`s most lucrative market, but sales have plummeted to a historic low. Given the trends of the last two quarters, Gazprom will deliver less than 16 bcm of natural gas to Europe, a massive plunge compared to the 175 bcm delivered in 2021. The Russian company is producing way more gas that it can sell, with about 15 % of the annual output remaining unused. No wonder that a few years back we saw desperate gas flaring as Russia needed to literally burn the gas in the atmosphere as it had no destination nor storage.

This comes on top of a) series of severe Ukrainian drone strikes on key gas/petroleum Russian infrastructure, b) an already sick economy with a 17 % interest rate from the Central Bank, and c) the population literally withdrawing hundreds of billions of rubles each month. True, Russia is dangerous, but it is also extremely vulnerable and inherently weak. This is of strategic importance for the EU for its defence posture and also as pressure points against Moscow.

- Enforce Russian sanctions, cut LNG and close loopholes

All of these dynamics mean that the EU should continue its course for fully cutting itself of Russian gas supply, while also expanding its efforts in several key directions. Russian LNG continues to be among the main source of tanker supply for Belgium, France and Spain. Europe continues to rely on Russian fertiliser imports. Phasing out of Russian nuclear fuel remains distant. A “ghost fleet” of oil tankers and potential subversive equipment is sabotaging European undersea infrastructure and dodging international oil sanctions. The list goes on.

Unless there is steadfast political will and European commitment to fully tighten the screws against Putin’s multiple entry points and corrupt dependencies, the EU can only blame itself.

ENJOYING THIS CONTENT?